6 Best Banks for International Transfers and 5 Online Alternatives [2025]

If you need to send an international payment you may be considering using your normal bank as a secure and convenient option. Sending an international wire with your bank shouldn’t be too much of a headache – but it can be quite expensive, and because third party fees may creep in, your recipient might get less than you were intending in the end.

This guide walks through the pros and cons, features and fees of sending money overseas with 6 major US banks.

Banks aren’t your only option for moving money overseas – an online specialist service like Wise or OFX may be able to offer a better exchange rate, a lower overall cost, and a faster delivery. We’ll touch on a few alternatives to regular banks later, to help you compare and choose.

Best banks for international wire transfers: Key points

| Provider | Great for |

|---|---|

| Bank of America | Wide coverage, offering international wire transfers to over 200 countries in more than 140 currencies. |

| Chase | High transfers with no fees above $5,000 USD and a low cost fee of $5 for all transfers under $5,000 USD. |

| Citibank | Easy international transfers thanks to their easy-to-use online and mobile banking service. |

| Wells Fargo | Multiple sending options via phone, online or in-person at a local branch and no fees for outgoing transfers made in a branch. |

| PNC Bank | Sending payments to a broad range of countries. |

| US Bank | Multiple payout options and a flat transfer fee regardless of how you set up your payment. |

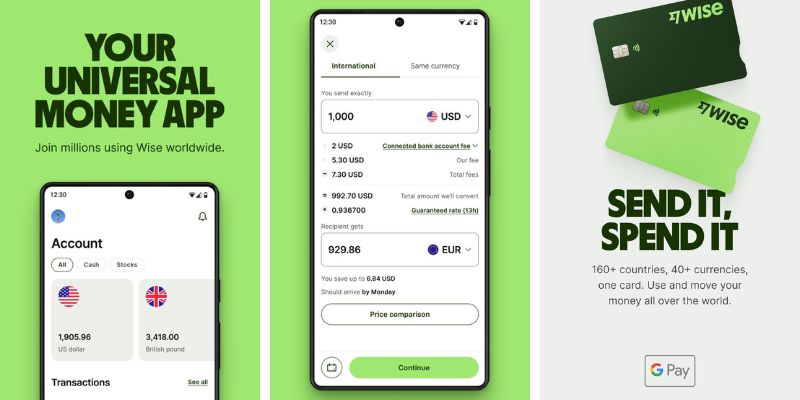

| Wise | Sending payments to 160+ countries using the mid-market exchange, without hidden fees. |

| OFX | No transfer fees for digital international transfers sent in a foreign currency and wide global coverage with transfers available in over 50 currencies. |

Which bank is best for international transfers?

The best bank for your international transfer may not be a bank at all. Specialist services can often provide lower fees and a better exchange rate compared to your bank. We’ll look at a few specialist alternatives in just a moment, but first let’s see how our 6 big banks measure up against online providers like OFX and Wise on fees and exchange rates.

| Provider | International wire fee | Exchange rate | Transfer speed |

|---|---|---|---|

| Wise | Low fee which varies by destination, transparent fee structure | Mid-market exchange rate | 50%+ of payments are instant, 90% arrive in 24 hours* |

| OFX | No fee | Exchange rate includes a small markup | 1 – 2 days in most cases |

| Bank of America | Digital payments in a foreign currency have no transfer fee | Exchange rate includes a markup on the mid-market rate | Usually within 2 days |

| Chase | $5 per transfer for online payments, with fees waived for payments of $5,000 or more | Exchange rate includes a markup on the mid-market rate | 2 – 5 business days |

| Citibank | Digital payments in a foreign currency may have no transfer fee or cost up to $35, depending on your account type | Exchange rate includes a markup on the mid-market rate | Variable delivery time based on country |

| Wells Fargo | Digital payments in a foreign currency may have no transfer fee | Exchange rate includes a markup on the mid-market rate | Variable delivery time based on country |

| PNC | $50 for agent-assisted transfers, $40 for self-service sent in US dollars | Exchange rate includes a markup on the mid-market rate | 3 days |

| US Bank | $50 for all outgoing international transfers | Exchange rate includes a markup on the mid-market rate | 2 – 3 days |

*The speed of transaction claims depends on individual circumstances and may not be available for all transactions. (Information correct 20th November 2024)

As you can see, the upfront transfer fees from major US banks do vary widely. Exchange rate markups and third party costs can also apply even where transfer fees are waived, which push up the price further.

You may find online international money transfer services such as Wise or OFX for international transfers with more transparent fees and – often – a better exchange rate. More on that later.

Best online providers for international wire transfers: Overview

Sending your international payment with a bank is secure and familiar. But it may also be expensive or slow. Specialist money transfer services are safe to use – they’re usually regulated in the same way your bank is – and can often offer a lower overall cost. Here are a few to consider:

- OFX: Make payments in 50+ currencies online, in app and by phone. There’s no transfer fee and the rates offered can beat the banks

- Wise: Send to 160+ countries, with the mid-market exchange rate and low, transparent fees. 50%+ of payments arrive instantly

- TorFX: Send money online or over the phone, and get award winning customer service if you want to talk through your options

- WorldRemit: Online and in app payments to a range of countries around the world, with a good range of pay out methods

- Remitly: Send digitally on popular remittance routes, and pick a faster Express fee or a cheaper Economy service

Things to consider when choosing an international transfer provider

Not sure how to arrange your international wire? Here are some factors to consider when you’re deciding:

- Costs – before you get started make sure you’ve thoroughly read the payment fee schedule. The transfer fee you pay can vary widely depending on how you structure the payment.

- Speed – international wires commonly take 3 to 5 days to arrive in the destination account when sent with a traditional bank. Check the delivery times when you arrange your payment.

- Exchange rates – compare the exchange rate your bank offers against the mid-market rate you’ll find on Google. It’s common for banks to add extra fees here, so doing a bit of homework and looking at a few alternatives can save you money.

- Convenience – check out the options for sending your payment – while many banks let you set things up online or in an app, some still require you to head into a branch in person.

- Payment method options – Different providers support various payment methods. Some might let you pay via direct bank transfer, while others might accept credit cards, debit cards, or even digital wallets. Choose a provider that supports the most convenient and cost-effective payment method for you.

- Limits – Be aware of any minimum or maximum transfer limits. Some banks and services are better suited for small, frequent transfers, while others might be more appropriate for larger transactions. Check if the limits align with your transfer needs.

- Customer support – Is 24/7 customer support important to you? Consider the level of customer support that your chosen provider offers. It’s important to have access to prompt and helpful support in case any issues arise during the transfer process. Look for providers that offer 24/7 support via multiple channels such as phone, email, and live chat, and read customer reviews to gain a more accurate, wider picture.

Navigating the intricacies of international money transfers can be daunting, but companies like Wise and OFX are international money specialists. With a track record of delivering swift transfers, competitive exchange rates, and the added convenience of user-friendly apps, they’ve emerged as frontrunners in the industry. We’ll delve deeper into what makes these providers stand out in the next section.

Which US banks accept international wire transfers?

In this guide, we’ve looked at 6 of the most popular banks in the US, to see how they measure up on international wire transfers. We’ll look at the fees, rates, limits, pros and cons of each of the following banks in the US:

- Bank of America

- Chase

- Citibank

- Wells Fargo

- PNC bank

- US Bank

Bank of America international transfers

You can make convenient international transfers with Bank of America online or using the BoA app. If you’re sending a payment in a foreign currency you won’t pay a transfer fee for digital payments – however, there are fees which are added to the exchange rate used.

If you’d prefer to send a payment overseas in USD there’s a 45 USD transfer fee to pay.

Bank of America international wires can also be arranged in person at a Bank of America Financial Center – you’ll need to make an advance appointment to do this, and fees apply.

You can send money to 200+ countries in 140+ currencies with Bank of America. Payments usually arrive in 1 or 2 banking days as long as they’re processed in working hours.

| Bank of America pros | Bank of America cons |

|---|---|

| ✅ No transfer fee for digital international transfers sent in a foreign currency ✅ Send online or in person depending on your preference ✅ Extensive global coverage with services in over 200 countries and 140+ currencies ✅ Quick process times, typically in 1-2 days | ❌ Exchange rate markups apply ❌ Third party charges may apply which are deducted from the send amount |

BoA international wire transfer fees

- International wire transfer incoming: Fees vary according to account type

- International FX wire transfer outgoing (online): No transfer fee

- International USD wire transfer outgoing (online): 45 USD

- International wire transfer arranged in branch: Fees vary according to account type

BoA exchange rate

The Bank of America exchange rate is described as an ‘all in’ rate. That means it may include profits, fees, costs and charges added by BoA.

You’ll notice that the rate you’re offered isn’t the same as the one you can find online with a Google search, or using a currency converter tool. What you find online is the mid-market exchange rate – the rate banks get when they buy currency themselves. However, most banks – like Bank of America – don’t pass this rate on to customers. Instead they add in their own fees and costs to calculate a retail exchange rate, which means you pay an extra fee here.

BoA international transfer limits

- Bank of America has a $1,000 limit for online payments made from consumer accounts.

- Business account holders can send $5,000 online.

You may be able to have your digital payment limit raised if you complete additional security and verification processes – or you can make your payment in a branch instead.

Chase international wire transfers

You can send a Chase international wire transfer in USD or a foreign currency, online, using the Chase app, or in person by visiting a branch. If you’re sending your international payment in a foreign currency online or via the Chase app you’ll only pay a 5 USD fee for transfers under 5,0000 USD in value, with transfer fees waived entirely for higher value payments. You’ll still pay costs in the form of an exchange rate markup added by Chase, though.

Send money to 90+ countries as a personal customer – and 140+ countries if you have a Chase business account.

| Chase pros | Chase cons |

|---|---|

| ✅ Low or no transfer fee for online and mobile payments in a foreign currency ✅ Send transfers in branch, online or using the mobile app for convenience ✅ Suitable for both personal and business customers ✅ Wide reach to 90+ countries | ❌ High fees for international wires in USD or arranged in branch ❌ Exchange rate markups and third party fees may apply |

Chase international wire transfer fees

- International wire transfer incoming: 15 USD

- International wire transfer outgoing, arranged in branch: 50 USD

- International wire transfer outgoing in USD: 40 USD

Chase online and mobile international FX wire transfer fees:

- Under 5,000 USD in value: 5 USD

- Over 5,000 USD in value: Fee waived

Chase exchange rate

The Chase exchange rate includes a markup on the mid-market exchange rate. That’s an extra fee, described by Chase as a spread and commissions for themselves and their partners.

The exact rate you’re offered depends on the account you hold, the specific payment being made, the currencies and payment amounts involved. Chase states that you should expect the rate you’re given to be less favorable than the rate you’ll find online with a simple Google search.

Related: Chase foreign transaction fees

Chase international transfer limits

Chase international transfer limits can vary depending on the account you hold and the way you’re setting up your payment. If your payment would exceed your personal limit when you’re arranging it online, you’ll be notified. You may be able to make a higher value transfer by visiting a branch in person.

Citibank international transfers

The easiest way to make a Citibank international transfer is through the online and mobile banking service. You’ll simply need to log into your account and follow the prompts to enter your recipient’s details and process the transfer.

Citibank international wire transfers can be made as a one off payment or on a recurring basis. The fees you pay will depend on the account you have with Citi – all transfer costs are waived for online payments made in a foreign currency by customers who hold the Citigold Account Package, but fees may apply to some other transfer types.

| Citibank pros | Citibank cons |

|---|---|

| ✅ Low transfer fees compared to other banks, which may be waived for online payments ✅ Send money online for convenience, or visit a branch if you’d prefer in person service ✅ High daily transfer limits ✅ Convenient mobile banking platform for managing international transfers | ❌ Fees vary according to the account you hold ❌ Exchange rate markups apply |

Citibank international wire transfer fees

Citibank’s fees may vary based on the account you hold. Many of the Cit accounts and banking packages for high wealth individuals have fees waived. For regular Citi accounts:

- International transfers (outgoing) – $35

- International transfers (incoming) – $15

Citibank exchange rate

The Citibank exchange rate includes a markup on the mid-market exchange rate. That’s a fee for currency conversion, but it’s hard to spot because it’s rolled up into the rate you’re offered for your payment. Compare the Citi rate against the mid-market exchange rate you’ll find on Google. The difference is the Citibank exchange rate fee.

Citibank international transfer limits

Citibank’s international transfer limits vary based on the account you hold and whether or not you’re sending to another Citi account. For standard Citi accounts there’s usually a $50,000 daily limit for transfers to non-Citibank accounts around the world.

Wells Fargo international transfers

You can send an international transfer with Wells Fargo online, by phone, or in person at a branch. Sending payments online using the digital banking service is usually the quickest, cheapest and most convenient option. You’ll simply need to log into your account and follow the prompts to enter all the required details to set up your transfer.

Wells Fargo international transfer fees vary by account type. Some accounts may have a fixed number of free transactions such as incoming international wires. However, the specific terms and conditions vary between accounts significantly, so you’ll need to double check the rules for your own account before getting started.

| Wells Fargo pros | Wells Fargo cons |

|---|---|

| ✅ Safe and familiar service ✅ Send payments online, by phone or in person at a branch ✅ Quick and convenient online transfers ✅ Relatively high daily limit of $5,000 | ❌ Exchange rate markups apply ❌ Fees are relatively high |

Wells Fargo international wire transfer fees

Here are the standard Wells Fargo fees – you’ll need to double check the terms of your own account before you get started to make sure there are no surprises:

- International wire transfer incoming: 15 USD

- International wire transfer outgoing (made in branch) in foreign currency: $0

- International wire transfer outgoing (made in branch) in US dollars: $40

- International wire transfer outgoing (online or mobile): fee waived

Wells Fargo exchange rate

The Wells Fargo exchange rate includes a markup which is an extra fee rolled up in the exchange rate you’re offered.

The rate you find when you run a Google search or use a currency converter tool is the mid-market exchange rate. However, this isn’t the same as the rate you’ll be given when you send an international transfer with Wells Fargo. Instead, Wells Fargo – like most banks – will add a markup to the mid-market rate to calculate their retail rate. That means a less favorable rate for you, and a little more profit for the bank.

Related: Wells Fargo foreign transcation fees

Wells Fargo international transfer limit

The Wells Fargo international wire limit may vary depending on your account type and the exact service you need. There’s a $5,000 daily limit for the Express Send service.

PNC international transfers

Depending on where you’re sending a payment to, and the send amount, you may be able to make a low cost international money transfer. If this option isn’t available for your transaction, standard international transfer fees will apply.

Some PNC accounts are only eligible for international transfers initiated in a branch – the service isn’t available online or through the mobile app for example. Check your own account type for details. Learn more: PNC International Transfer

| PNC pros | PNC cons |

|---|---|

| ✅ Where international money transfers are available they come with low transfer fees ✅ Send payments to a broad range of countries | ❌ High fees for standard international payments ❌ Extra fees may also creep in – transaction limit charges and third party costs for example ❌ Exchange rate markups apply |

PNC international wire transfer fees

- International money transfer (where available): 5 USD

- International transfer outgoing – self service: 40 USD

- International transfer outgoing – agent assisted: 50 USD

- International transfer incoming: 15 USD

PNC exchange rate

The PNC exchange rate is not available via the PNC desktop site. To get the live rate for your transaction you’ll need to log into your account, call the bank or pop into a PNC branch.

The PNC exchange rate is likely to include a markup on the mid-market exchange rate you’d find on Google or with a currency converter tool.

PNC International transfer limits

How much you can send with PNC will depend on your account type. You’ll be able to find out your account limits by looking at the account terms and conditions, which are usually available online.

US Bank international transfers

Depending on your account type you may be able to send your international payment through the US Bank online banking service. If not, you’ll need to visit a US Bank branch to arrange your payment in person.

US Bank international wire transfers have a 50 USD fee whether you send online or in a branch. To send your payment online you’ll need to log into your digital banking service and follow the onscreen prompts to enter your recipient’s information and process the payment. You’ll be shown the applicable fees and rates before you confirm the transaction.

| US Bank pros | US Bank cons |

|---|---|

| ✅ Safe and familiar option ✅ Make your payment online or in a branch for in person service ✅ Flat transfer fee regardless of how you set up your payment | ❌ Not all customers can send money through digital banking ❌ High transfer fees + possible third party charges ❌ Exchange rate markups apply |

US Bank international wire transfer fees

- International wire transfer incoming: 25 USD

- International wire transfer outgoing: 50 USD

US Bank exchange rate

The exchange rate used by US Bank is likely to include a markup added to the mid-market exchange rate.

US Bank international transfer limits

US Bank’s international transfer limits can vary based on the payment type. If you’re in a branch, the member of the service team will be able to tell you the limit for your specific transfer, and if you’re arranging the payment online, the limits will be shown on screen if you hit them.

Related: International money transfer limits

Online international wire transfer services

At the end of the day there’s no single best way to send your international payment. It depends on the transfer value and currency, so comparing a few different options is your best bet. Online providers like these we’ve detailed above can often offer lower overall costs and give you an instant quote online so you can easily see which works best for you. Let’s look at these alternatives more in detail:

| OFX | Wise | TorFX | WorldRemit | Remitly | |

|---|---|---|---|---|---|

| Coverage | 170 countries 50+ currencies | 160+ countries 40+ currencies | 120+ countries 40+ currencies | 130+ countries 70 currencies | 170+ countries 100+ currencies |

| International transfer fees | No transfer fees | Low and transparent transfer fees | Fee free for all transfers. Fee is built into the exchange rate | Fees vary by destination and payment type | Fees vary by destination and delivery option selected. |

| Exchange rates | Exchange rates include a small markup | Mid-market exchange rate | Exchange rates include a markup | Exchange rates include a markup | Exchange rates include a markup |

| International transfer speed | Most payments arrive in 1 – 2 days | 50% of payments are instant* 90%+ of payments arrive in 24 hours | 1-2 business days for most transfers | Cash collection and mobile money payments may be instant Deposits to bank accounts may be instant or take a day or 2 to arrive | Immediate Express delivery, Economy payments take 3-5 business days |

| Transfer limits | Usually unlimited | Limits vary by currency – usually around 1 million GBP | Usually unlimited | 9,000 USD per day | Variable limits, up to 10,000 USD per day |

OFX international money transfer

OFX allows customers to transfer money internationally without any transfer fees, providing only a small markup on the exchange rate that is often cheaper than traditional banks. They have a wide global coverage with transfers available in over 50 currencies to 170+ countries.

- No transfer fees: A cost-effective option for large transactions.

- Competitive exchange rates: Small markup on the mid-market rate.

- 24/7 support: Assistance available anytime for transfer-related inquiries.

Wise international money transfer

Wise offers international transfers at the mid-market rate with no hidden fees. Customers can send money to over 160 countries and many transfers arrive instantly* or within 24 hours.

- Mid-market exchange rate: Wise uses the mid-market exchange rate compared to banks which often add a hidden markup to the exchange rate.

- Instant transfers: Over 50% of payments arrive instantly*.

- Low and transparent fees: Fees vary by destination, starting from 0.39%.

*The speed of transaction claims depends on individual circumstances and may not be available for all transactions

TorFX international money transfer

TorFX is another alternative provider that offers fee-free transfers with no maximum limit. With more than 40 global currencies available, transfers are processed on the same day or within 2 working days if you’re sending money to an exotic destination. Customers also get the added benefit of a dedicated account manager for more personalized service.

- No transfer fees: Customers can enjoy zero transfer fees, only paying for the exchange rate.

- Flexible transfer options: Multiple transfer options available.

- Wide range of currencies: Send money in over 40 global currencies.

WorldRemit international money transfers

With WorldRemit, customers can send money to over 130 destinations worldwide using various payout options like cash pickups, bank transfers, mobile money, and airtime top-ups. The cost and speed of a transfer varies depending on the receiving country and receiving and payment method.

- Multiple payment options: Payment choices include via bank transfer, debit or credit card or Apple Pay.

- Transfer limits: Maximum send amounts vary, with limits set at 9,000 USD per every 24 hours and 5,000 USD per transaction via a debit, credit or prepaid card.

- Fast transfer times: In most cases, transfers will arrive within minutes.

Remitly international money transfers

Remitly supports international transfers in over 100 currencies to 170 countries. Transfer fees will vary depending on the destination, but a service fee is added to the transfer amount, and the exchange rate includes a markup on the mid-market rate. Customers can choose from two transfer speeds: economy, which takes 3-5 business days, and express delivery, which can be immediate.

- Multiple payment options: Pay by bank transfer, credit or debit card.

- Wide coverage: Send to over 170 countries and territories in over 100 currencies.

- Wide range of options for receiving money: Transfers can be deposited into your recipient’s bank account or as a cash pickup or home delivery. Other options also include a mobile money account or a debit card deposit depending on your recipient’s location.

Learn more: Best international money transfer apps

International wire transfer fees with banks: Quick summary

Let’s start with an overview of the fees that apply to international wires from 6 big banks:

- Bank of America – Digital payments in a foreign currency have no transfer fee*

- Chase – $5 per transfer for online payments, with fees waived for payments of $5,000 or more*

- Citibank – Digital payments in a foreign currency may have no transfer fee or cost up to $35, depending on your account type*

- Wells Fargo – Digital payments in a foreign currency may have no transfer fee*

- PNC bank – $50 for online transfers, $40 for assisted transfers*

- US Bank – $50 for all outgoing international transfers*

*These outbound wire transfer fees do not take into account the exchange rates charged by the banks which almost always include additional costs and charges.

Types of fees for international money transfers with banks

US banks will charge you in several different ways for an international wire transfer:

- Bank sending fee: The bank will charge a fixed fee for each international money transfer that you make. This fee can vary depending on the type of account you have, how you’re making the transfer and the currency you send.

- Exchange rate markup fee: A US bank typically offers a worse exchange rate than the base exchange rate, often between two and four percent worse than you might get elsewhere. This is a hidden fee as the bank pockets the difference.

- Correspondent bank fee: Third party charges which can be called agent fees, intermediary fees, SWIFT fees or correspondent bank fees. You may not be able to see the exact cost of these charges in advance of confirming your transfer.

- Receiving bank fee: Finally, the beneficiary’s bank will probably charge a fee for them to receive the money into their account.

All of these fees do add up and can mean the beneficiary ends up receiving quite a bit less than you sent them. When we’re comparing fees below, we’ve only included the bank sending fees, as most US banks don’t share the exchange rates they use and the correspondent and receiving bank fees vary so much.

International wire transfer fees for US banks

Here’s an overview of the typical costs for sending an international wire with 6 large US banks. The exact price you pay may vary based on how you set up your transfer – in branch payments are often more expensive than online transfers for example, and payments made in USD overseas can also attract further fees.

| Provider | International wire fee |

|---|---|

| Bank of America | Digital payments in a foreign currency have no transfer fee |

| Chase | $5 per transfer for online payments, with fees waived for payments of $5,000 or more |

| Citibank | Digital payments in a foreign currency may have no transfer fee or cost up to $35, depending on your account type |

| Wells Fargo | Digital payments in a foreign currency may have no transfer fee |

| PNC | $40 for online transfers, $50 for assisted transfers |

| US Bank | $50 for all transfers |

*Information is correct on 23rd of April 2024

How to avoid international transfer fees with banks

With charges added into the exchange rates and hard to spot intermediary bank fees, international wire transfers with traditional banks can be costly.

Here are some tips on how you could keep your costs down:

- Sending money through your bank’s online or mobile banking service is almost always cheaper than visiting a branch

- If you need to send someone a lot of money, using one larger payment can be cheaper than sending several small transfers, thanks to the fixed transfer fees that apply

- If you can, use a specialist international payment provider. You’ll be able to make your payment online or in an app for convenience, and can often find lower costs and a better exchange rate compared to a regular bank

- Compare some different transfer services to make sure you get the best value for your particular payment

Are you looking to make a business payment? This guide is for you: Best international money transfer apps for business

Best bank for international wire transfers with no fees

You’ll notice that some banks and non-bank alternative providers state that they don’t charge a fee for international wires. This means there’s not an upfront transfer fee associated with processing your payment. It doesn’t, however, mean that the payment is entirely free.

The costs of sending an international wire aren’t just in the transfer fee – you may also find a fee added to the exchange rate that’s used to convert your dollars to the currency required for depositing in the recipient’s account. So, while there might not be a transfer charge associated with the payment, the costs can still mount up pretty quickly especially if you’re sending a high value transfer or making multiple payments.

If you’re looking for a bank which does not have a transfer fee, you might consider:

Chase: No transfer fee for payments over 5,000 USD in value, when made online – exchange rates will include a markup

Wells Fargo: Transfer fees could be waived on certain account types, and when arranging a payment electronically – exchange rates will include a markup

Citibank: Some accounts include some wire transfers which don’t have a fee, but exchange rates will include a markup even where fees are waived

Or, you may want to try a non-bank alternative instead, to see if you can process your payment with no transfer fee and a better exchange rate. Check out OFX which offers international payments which have no transfer fee and which use a competitive exchange rate.

Best bank to send large amounts of money internationally

Banks set their own limits on the amount of money you can send overseas using a wire. This limit can vary depending on the account you have, and also according to the bank’s security protocols. This can mean you don’t always know in advance what your transfer limit is – although you’ll be shown the limit when you start to set up your payment online. If you exceed your bank’s digital transfer limit you may still be able to make an overseas wire through your local bank branch. You can call in and talk through your options with a team member – but the fees are often higher for this compared to using a digital service.

It’s also important to note that exchange rate markups will usually apply. As a percentage fee, this can mount up extremely quickly if you’re sending a higher value transfer. Compare The rate you’re quoted against the mid-market rate you can get from Google, to check the markup being used for your specific transaction.

Here’s a quick look at some popular US banks and non-bank alternative, on high value payments:

| Bank/provider | Transfer limits | Transfer options | Fees |

|---|---|---|---|

| Wise | Variable limits – usually around 1 million GBP or equivalent | Online and in app | From 0.33%, with volume discounts when sending over 20,000 GBP/month |

| OFX | Usually unlimited | Online, in app, by phone | No transfer fee – small exchange rate markup used |

| Wells Fargo | Variable limits for online payments – branch transfers have higher limits | Online, in app, in branch | 25 USD + exchange rate markup |

| Bank of America | Variable limits | Online, in app, in branch | No fee for foreign currency digital payments, 40 USD for branch payments Exchange rate markup applies |

| Chase | Variable limits | Online, in app, in branch | No fee for foreign currency digital payments over 5,000 USD. 5 USD fee for smaller payments Exchange rate markup applies |

(Information correct at the time of writing – 20th November 2024)

Online banks that accept international wire transfers

You’ll need to check with your own bank or account provider if they’re able to allow you to receive an international wire. Some services – like Chime – don’t support international payments. Others may restrict the use of international wires to customers who have a specific account type.

That said, where your bank and specific account type does support online transfers, this can be the cheapest and easiest way to send an overseas wire. You’ll often find that banks waive or lower the costs of sending a digital payment compared to visiting a branch – although using a third party service may still work out cheaper in the end.

Some banks do limit the amount you can send or receive digitally – this again may vary depending on the account type you have. If you can’t send your payment using an online or in-app transfer, you might find you have to visit a branch to set up your transfer. This can often cost more in the end. Here’s a quick summary of some options for online international transfers:

Wells Fargo: Send digital transfers online and in app, with fees waived when sending foreign currencies – limits apply which vary based on your account type

Bank of America: Digital transfers are available, but there are limits which can change according to your account type and usage. Consumer banking online limits can be as low as 1,000 USD for some accounts

US Bank: Send money online from an eligible account, which you must have held for at least 6 months. Fees of 50 USD apply

Wise: Send payments to 160+ countries online and in app, with fees from 0.33% and the mid-market exchange rate

OFX: Send transfers in 50+ currencies with no upfront transfer fee and a low exchange rate markup – payments can be arranged online and in app once you have registered

XE Money Transfer: Send money all over the world, with low or no fees depending on the destination and the patent type

Other US banks that accept international wire transfers

Many banks in the US accept international wire transfers, whereas some US banks like Ally Bank do not send international wire transfers. We have these guides on different US banks and their international wire transfers including fees, exchange rates, limits and possible alternatives.

- Capital One International Wire Transfer: A familiar and secure option with a wide range of countries, currencies, and optional convenient face-to-face transfers in branch.

- Charles Schwab International Wire Transfer: Great for those who need to send higher transactions with a limit of up to $100,000 online per day and a relatively low upfront transfer fee.

- Fidelity International Transfer: International stockbroker with over 20 available currencies and broker support.

- Fifth Third Bank International Wire Transfer: Convenient for those who are already Fifth Third Bank account holders with cash, branch, and online transfer options.

- Navy Federal International Wire Transfer: Great for sending money all around the world for the same $25 USD fee using a familiar and secure service.

- TD Bank International Wire Transfer: With no minimum or maximum amount, TD Bank is a great option for those who need to transfer high amounts.

- Truist International Wire Transfer: A familiar and reliable bank with international fee waivers for some account types

- USAA International Transfer: Request a transaction via the phone if you don’t have access to the internet for a secure transfer via the SWIFT network.

- Ally Bank doesn’t support international wire transfers. However, there’s no fee to receive incoming international wires. Our Ally Bank International Wire Transfer Alternatives guide might help if you’re looking for an alternative.

How to send money internationally

Sending money abroad doesn’t have to be complicated, but the exact steps for transferring money internationally will differ based on your chosen method and provider. Here’s a general guide to help you understand what to expect:

- Choose a provider – Choose a financial provider that best suits your needs and preferences, considering factors like fees, exchange rates, transfer speeds, currency options, and the countries they operate in.

- Sign up – Once you’ve chosen a provider, you can sign up for an account in person or online. You’ll usually have to provide ID and proof of address to verify your identity.

- Choose your currency and how much you want to send – Select the amount you wish to send and the currency you want to send it in.

- Enter recipient details – You’ll need to provide your recipient’s bank account details, such as their IBAN or SWIFT code. Make sure that all details are accurate to avoid delays.

- Pay for your transfer – Depending on your provider, you may have the option of various payment methods like credit or debit cards. Remember, each payment method may come with different fees or processing times.

- Send your transfer – Review all the details and confirm your transfer. Most services let you initiate transfers online or via an app to make the process quick.

- Track the process – Some providers offer tracking options so you can see the status of your transfer in real-time. Notifications may also be available to alert you once the transfer is complete.

If you are going to send or receive money internationally, it’s important to know the relevant taxes and regulations. You can learn more about them here: International wire transfer regulations and taxes.

Best bank to receive money from overseas

There are several options when it comes to receiving money from overseas. If you’ve got a USD account with a local bank you’ll find your incoming payment is converted from the foreign currency to dollars, either by the sender’s bank, an intermediary, or your own bank. You may pay a fee included in the exchange rate and also an incoming wire fee.

The alternative which suits many people is to get a multi-currency account from a provider like Wise or OFX. These accounts come with local account details for foreign currencies, so the person sending you money can simply have the payment deposited to your account in their home currency without needing to convert it to dollars. This puts you back in control of currency conversion, so you can hold your balance in the foreign currency, or switch it over to USD when you spot a good exchange rate.

Here’s how a few banks and nonbank alternative work for inbound payments:

Chase: Incoming wire payments are waived if the transfer is sent from another Chase account – otherwise there’s a 15 USD fee

Bank of America: Incoming wire payments may apply when your currency is received, which can vary by account type

Wells Fargo: 15 USD incoming payment fee applies in most cases – some accounts may offer courtesy refunds of fees, so do check directly with the bank

Wise: Wise is not a bank, but does offer a smart multi-currency account which allows you to receive payments in USD and 8+ other currencies with local and SWIFT account details

OFX: OFX isn’t a bank but has business accounts for ecommerce sellers and SMEs which ome with local account details you can use to receive payments in 7 currencies hassle free

Conclusion: What is the best bank for international wire transfer?

Using banks for international wire transfers can be convenient and secure but is also often expensive thanks to complicated fees and poor exchange rates. It’s also not often the fastest option, with bank wires commonly taking several days to arrive, depending on the destination.

Specialist services like Wise and OFX are a good option for a faster payment which can be cheaper too. Compare a few options to see which works best for you.

FAQs on best US banks for international transfers

What is the best way to transfer money internationally?

There’s no single best way to send money internationally – but specialist digital providers like Wise, OFX or WorldRemit can often offer a lower overall cost compared to your normal bank.

What is the cheapest way to wire money internationally?

Sending a payment with a specialist online service may work out cheaper than using your banks. Compare a few options – you can often get an instant, no obligation quote, so it’s easy to see which works best for you.

Which bank does not charge wire transfer fees?

Some banks like Chase will sometimes waive international wire fees – but it’s worth remembering that there are likely to be extra costs added into the exchange rates applied in this case.

Which US banks accept international wire transfers?

Get paid from around the world into your US bank account – most major banks will let you receive an international wire to your account, although fees may apply. You can also check out online specialist providers like OFX, Remitly and Wise which often offer better rates and lower overall costs on international wire transfers.